Impact of Rates on Melbourne Suburbs

Recent shifts in interest rates can significantly influence Melbourne's suburban property market. Understanding these dynamics is key for buyers and investors alike. What steps will you take to navigate this evolving landscape?

What You Will Learn

- The recent cuts in interest rates from 4.35% to 3.85% have increased buyer confidence and borrowing capacity.

- Lower interest rates lead to more loan approvals, allowing households to allocate higher budgets for property purchases.

- Melbourne’s suburban property market shows modest growth, with a rate of only 1.1% in Q2 2025, signaling a potential cooling trend.

- Understanding the role of mortgage rates is crucial, as rising property prices continue to challenge affordability for many buyers.

- Engaging with local real estate experts can provide valuable insights into suburb performance and investment opportunities.

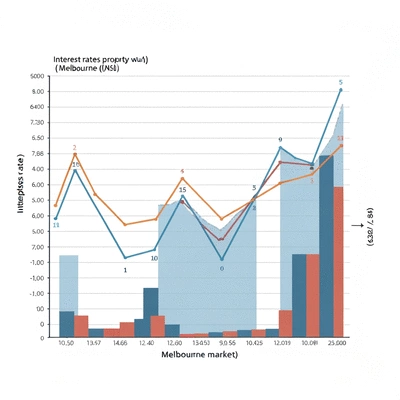

Melbourne Property Market Dynamics

An overview of interest rate changes and their impact on Melbourne's suburban property market performance and borrowing capacity.

Understanding the Relationship Between Interest Rates and Property Trends

As we navigate Melbourne's suburban property market, it's vital to grasp how interest rates influence buyer behavior and market dynamics. Recent cuts by the Reserve Bank of Australia (RBA) from 4.35% to 3.85% have begun to reshape the landscape. When borrowing becomes cheaper, it often leads to increased buyer confidence, which can spark activity in the property market. For more in-depth analysis, read our Melbourne Property Market Insights 2025.

The reduced interest rates can enhance borrowing capacity, making it easier for potential buyers to enter the market. This shift not only affects first-time homebuyers but also impacts investors looking to expand their portfolios. More accessible financing options can drive demand and, ultimately, influence property prices across various Melbourne suburbs.

How RBA Rate Cuts Influence Borrowing and Buyer Confidence

Let’s break down how these rate cuts are playing out in the real world. When interest rates decrease, buyers often feel more confident about their purchasing decisions. Here's what happens:

- Increased loan approvals as banks become more willing to lend.

- Greater disposable income for households, allowing for higher property budgets.

- Enhanced overall market sentiment, encouraging buyers to act sooner rather than later.

This cycle of increased borrowing and heightened confidence tends to create a ripple effect in the property market, essential for those of us at My Metro Life as we analyze trends and data.

Current Performance of Melbourne’s Suburban Property Market

As we look at the current state of Melbourne's suburban property market, it’s crucial to note that growth has slowed significantly. The latest figures reflect a modest growth rate of 1.1% in Q2 2025, which is notably below the national average. This can indicate a cooling market, where certain suburbs are experiencing flatlining prices.

- Suburbs like Sunshine and Frankston have shown minimal growth.

- A few areas have even seen slight declines, sparking concern among potential investors.

- Understanding these trends can help homeowners and investors make informed decisions.

Keeping a finger on the pulse of these fluctuations can help us guide our clients at My Metro Life in making savvy real estate choices. For further details on specific areas, see our guide on Melbourne's Best Suburbs for Investment.

The Role of Mortgage Rates in Property Affordability

Mortgage rates play a pivotal role in the affordability of housing in Melbourne's suburbs. Even with lower interest rates, the rising property prices mean that affordability remains a challenge for many buyers. As we continue to monitor these trends, it's essential to consider:

- The impact of fixed versus variable mortgage rates on monthly payments.

- How lenders assess affordability based on income and existing debts.

- The long-term implications of borrowing at current rates versus future expectations.

By understanding these elements, we can better assist our clients in navigating the nuances of mortgage options and making confident buying decisions.

We Want to Hear From You!

As you consider your journey in Melbourne's suburban property market, what factors weigh most heavily on your decision-making? Is it interest rates, property prices, or perhaps the community vibe? Share your thoughts below:

Frequently Asked Questions (FAQs)

Q: How have recent interest rate cuts impacted Melbourne's property market?

A: Recent RBA rate cuts from 4.35% to 3.85% have increased buyer confidence and borrowing capacity, making it easier for potential buyers to secure loans and allocate higher budgets for property purchases.

Q: What is the current growth rate of Melbourne's suburban property market?

A: Melbourne's suburban property market recorded a modest growth rate of 1.1% in Q2 2025, which is below the national average. This indicates a potential cooling trend, with some suburbs experiencing minimal growth or flatlining prices.

Q: Do lower interest rates make property more affordable in Melbourne?

A: While lower interest rates enhance borrowing capacity, rising property prices mean that affordability remains a challenge for many buyers. It's crucial to consider the overall cost and compare fixed versus variable mortgage rates.

Q: What are some practical steps for buyers and investors in the current market?

A: Practical steps include thoroughly researching suburbs, utilizing current lower interest rates for borrowing options, connecting with local real estate experts, and considering off-the-plan opportunities. Leveraging real estate analytics can also guide smarter investment decisions.

Q: How can real estate analytics help in making smarter investments?

A: Real estate analytics can help by allowing you to analyze historical data for trends, evaluate rental yields, use Comparative Market Analysis (CMA) to gauge property values, and monitor economic indicators like employment rates and population growth that influence demand.

Summary of Key Insights on Melbourne’s Suburban Property Market

As we've explored, the relationship between interest rates and the dynamics of Melbourne’s property market is complex yet crucial. With recent cuts from 4.35% to 3.85%, borrowing capacity has increased, which generally boosts buyer confidence. However, it’s essential to recognize that the property prices in some suburbs remain high, challenging aspiring homeowners.

In addition, while the overall growth rate in Melbourne's property market has slowed to 1.1% in Q2 2025, some suburbs are experiencing stagnant prices. Understanding these trends helps navigate the current landscape effectively. Now, let’s take a closer look at how we, as buyers or investors, can engage with this evolving market.

Engaging with the Melbourne Property Market: Next Steps

Actionable Advice for Property Buyers and Investors

Entering the Melbourne suburban property market can be daunting, especially given recent trends. Here are some practical steps to consider:

- **Research Suburbs Thoroughly**: Identify suburbs with potential for growth and those experiencing stagnation.

- **Utilize Interest Rate Insights**: Leverage current lower rates to explore borrowing options that fit your budget.

- **Connect with Local Experts**: Engage with real estate professionals to gain deeper insights into specific suburbs.

- **Consider Off-the-Plan Opportunities**: Investigate new developments that might offer value in the long run.

Each of these steps will help you make informed decisions that align with your goals. Remember, the right information can make all the difference in your property journey!

Encouraging Informed Decisions in a Shifting Landscape

In a dynamic market like Melbourne's, understanding the underlying dynamics is crucial for making sound property decisions. As trends shift, staying informed about changes in interest rates and local market performance is vital. Here are a few strategies to ensure you remain on top of market changes:

- **Subscribe to Market Analyses**: Regular reports can provide insights into trends that affect property values.

- **Follow Local News**: Keep an eye on local government policies that may impact housing supply.

- **Attend Workshops and Seminars**: Engage with industry professionals to learn from their experiences.

By keeping abreast of market dynamics, you’re more likely to make choices that better fit your needs and aspirations.

Utilizing Real Estate Analytics for Smarter Investments

One of the most effective ways to navigate the Melbourne property market is by leveraging real estate analytics. These tools can help you assess market performance and guide your investment decisions. Here’s how you can use analytics effectively:

- **Analyze Historical Data**: Look for trends in property values over time to predict future movements.

- **Evaluate Rental Yields**: Understanding potential rental income is crucial for investment decisions.

- **Use Comparative Market Analysis (CMA)**: This helps you gauge the value of properties in specific suburbs.

- **Monitor Economic Indicators**: Keep track of factors like employment rates and population growth that influence property demand.

Incorporating analytics into your property strategy can empower you to make data-driven decisions, enhancing your chances of success in Melbourne’s vibrant real estate market. Remember, knowledge is power! For more on specific trends, explore our analysis of Melbourne Suburban Property Price Trends.

Recap of Key Points

Here is a quick recap of the important points discussed in the article:

- Recent interest rate cuts by the RBA from 4.35% to 3.85% have increased borrowing capacity and buyer confidence.

- Melbourne's suburban property market is experiencing modest growth of 1.1%, with some suburbs showing stagnation or slight declines.

- Understanding mortgage rates is crucial, as rising property prices can still challenge affordability despite lower interest rates.

- Practical steps for buyers include researching suburbs, leveraging interest rate insights, and connecting with local real estate experts.

- Using real estate analytics can enhance investment decisions by assessing market performance and understanding economic indicators.