Melbourne Property Market Insights 2025

As the Melbourne property market evolves, understanding its dynamics is crucial. Are you ready to dive into the key insights that will shape your your investment decisions for 2025?

What You Will Learn

- Market Recovery: Indicators suggest a potential increase in property values, particularly in previously undervalued suburbs.

- Rental Yields: Positive trends in rental yields indicate promising returns for informed investors.

- Government Incentives: Various programs can assist first homebuyers, enhancing their market entry.

- Ongoing Development: New infrastructure projects are likely to increase suburb desirability and property demand.

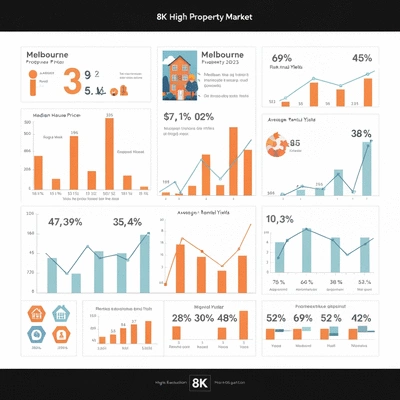

Melbourne Property Market Insights for 2025

This visual summarizes key market performance metrics, recovery indicators, and demand-influencing trends in the Melbourne property market for 2025.

Current Market Performance

- +2.5% Melbourne median house price (YoY)

- +1.8% National average (YoY)

- +3.2% Average rents increase

Signs of Recovery

- ↑ Increased buyer confidence

- ↑ More properties listed

- ↑ Infrastructure developments

Market Trends Influencing Demand

- Desire for green spaces & parks

- Urban renewal projects (inner suburbs)

- Remote work flexibility (further from CBD)

Key Investment Takeaways

- Market Recovery & potential upswing

- Encouraging Rental Yield trends

- Government incentives available

- Ongoing development & appeal boost

Understanding the Melbourne Property Market Landscape for 2025

As we look ahead to 2025, it's essential for homeowners, investors, and renters to grasp the Melbourne property market landscape. Recent trends indicate a shifting dynamic in property prices, and understanding these changes is crucial for making informed decisions. In this section, we will dive into the current market performance, signs of recovery, and the trends influencing buyer demand.

Current Market Performance: What the Numbers Say

Recent data shows a diverse performance across Melbourne's suburbs. On average, property prices have seen a modest increase over the past year, but how does this compare to national averages? Let's take a closer look:

- Melbourne’s median house price increased by 2.5% year-over-year.

- In contrast, the national average saw a rise of only 1.8% during the same period.

- The rental market remains strong, with average rents rising by 3.2%, indicating robust demand.

These figures suggest that Melbourne continues to be a competitive market for both buyers and renters. In my experience at My Metro Life, I've seen how these numbers can shift rapidly, so staying informed is key!

Signs of Recovery: Analyzing Growth Trajectories

As we analyze the signs of recovery within the Melbourne housing market, a few indicators stand out. For instance, there has been an uptick in buyer sentiment, which is often reflected in higher attendance at open homes and auctions. This renewed interest could signify a stable market on the horizon. For more details on specific areas, explore analyzing suburb performance for investment.

- Increased buyer confidence seen through higher auction clearance rates.

- More properties are being listed, indicating a healthy supply-demand balance.

- Infrastructure developments announced for several suburbs are likely to boost property values further.

These signs of stability and potential growth are encouraging for prospective buyers and investors. As we move forward, keeping an eye on these trends will be vital for making smart real estate choices.

Market Trends Influencing Buyer Demand

Understanding the factors influencing buyer demand can help individuals navigate the Melbourne property market more effectively. Recent trends show that lifestyle choices are increasingly affecting purchasing decisions.

- Desire for green spaces and proximity to parks is driving demand in family-oriented suburbs.

- Urban renewal projects in inner suburbs are attracting younger buyers and investors.

- Remote work flexibility is influencing buyers to consider properties further from the CBD.

These trends highlight the importance of aligning your property goals with broader market movements. At My Metro Life, I emphasize the value of not just looking at numbers, but also how they connect with lifestyle changes in Melbourne.

Investment Opportunities in Melbourne's Housing Market

Pro Tip

As you navigate the Melbourne property market, consider the long-term potential of suburbs that are currently undergoing significant infrastructure development. Areas with new schools, parks, and public transport options not only enhance lifestyle but often lead to increased property values over time. Prioritize these suburbs in your investment strategy for a more robust return!

FAQs about the Melbourne Property Market in 2025

What are the key indicators of market recovery in Melbourne for 2025?

Key indicators include increased buyer confidence, higher auction clearance rates, more properties being listed, and ongoing infrastructure developments. These factors collectively point to a stable and potentially growing market.

How do Melbourne's property price increases compare to the national average?

Melbourne's median house price increased by 2.5% year-over-year, outperforming the national average, which rose by 1.8% during the same period. This indicates a stronger performance for the Melbourne market.

What trends are influencing buyer demand in Melbourne?

Buyer demand is significantly influenced by lifestyle factors, such as a desire for green spaces and parks, urban renewal projects in inner suburbs attracting younger demographics, and remote work flexibility allowing buyers to consider properties further from the CBD.

Are there government incentives available for first homebuyers in Melbourne?

Yes, various government programs and grants, such as the First Home Owner Grant, are available to assist first homebuyers and enhance their market entry. It's recommended to research these options to maximize buying power.

How can I assess potential rental yields for investment properties in Melbourne?

You can use interactive tools like a Rental Yield Calculator, often provided by real estate platforms such as My Metro Life, to easily estimate potential returns on investment properties. Consulting with local real estate experts can also provide tailored insights.

Key Takeaways for Prospective Melbourne Property Investors

As we look ahead to 2025, the Melbourne property market presents a unique set of trends, opportunities, and challenges for potential investors. With ongoing recovery signs, current data suggests a more stable market landscape, making it an intriguing time to consider your options. Let’s summarize some crucial takeaways that can guide your investment decisions:

- Market Recovery: Signs of recovery indicate a potential upswing in property values, especially in previously undervalued suburbs.

- Rental Yields: Current rental yield trends are encouraging, suggesting good returns for savvy investors.

- Government Incentives: Programs aimed at first homebuyers can provide additional financial support for entering the market.

- Ongoing Development: Infrastructure projects are set to enhance suburb appeal, driving demand and future price increases.

As you consider your investment journey, remember that understanding the nuances of local markets can significantly enhance your success! For more insights into areas with strong rental returns, check out Melbourne's best rental yield areas.

Next Steps for Engaging with the Melbourne Property Market

Ready to dive into the Melbourne property market? Here are some actionable steps to help you navigate your investment journey:

- Assess Your Financial Position: Understand your budget and financing options before making any commitments.

- Utilize Government Incentives: Research available grants and programs like the First Home Owner Grant to maximize your buying power.

- Stay Informed: Regularly review market updates and reports to keep your knowledge current.

- Engage with Experts: Consult with local real estate professionals, like us at My Metro Life, to gain insights tailored to your needs.

These steps can pave the way for a more informed approach, helping you make confident investment choices!

Interactive Tools to Enhance Your Investment Decisions

At My Metro Life, we understand that making well-informed decisions is crucial for property investors. That's why we’ve developed some interactive tools that can help you assess rental yields and evaluate affordability tailored specifically to Melbourne:

- Rental Yield Calculator: Easily calculate potential returns on your investment properties.

- Affordability Assessment Tool: Determine what you can afford based on your income and expenses.

- Suburb Performance Tracker: Stay updated on the latest trends and performance metrics across various Melbourne suburbs.

Utilizing these tools will empower you to make decisions that align with your investment goals!

Your Roadmap for Success in the 2025 Melbourne Property Market

In conclusion, embarking on your property investment journey requires a clear roadmap. Here are some final thoughts to help you get started with confidence:

- Research Thoroughly: Dive into suburb specifics and market data to hone in on the best opportunities.

- Be Open to Learning: The market is constantly evolving, so stay adaptable and open-minded.

- Connect with the Community: Engaging with locals and real estate professionals can provide invaluable insights.

- Take Action: Don’t wait for the perfect moment. The right time to invest is when you’re prepared and informed! For more information on timing property transactions in Melbourne, consult our guide.

Start your property investment journey today with My Metro Life as your trusted guide, and watch as your real estate aspirations come to fruition in Melbourne’s vibrant market!

Recap of Key Points

Here is a quick recap of the important points discussed in the article:

- Current Market Performance: Melbourne’s median house price increased by 2.5% year-over-year, outperforming the national average of 1.8%.

- Signs of Recovery: Increased buyer confidence is evident through higher auction clearance rates and a healthy supply-demand balance.

- Market Trends: Lifestyle factors, such as the desire for green spaces and remote work flexibility, are influencing buyer demand.

- Investment Opportunities: Potential upswing in property values, encouraging rental yields, and ongoing infrastructure developments offer promising investment prospects.

- Next Steps: Assess your financial position, utilize government incentives, and engage with local real estate experts for informed decisions.