Finding Off-the-Plan Investments in Melbourne

Investing in off-the-plan properties can dramatically reshape your financial future. With Melbourne's real estate market buzzing with activity, understanding the latest trends is essential for making informed decisions. Are you ready to explore what this investment opportunity holds?

What You Will Learn

- Growing demand for sustainable living solutions is reshaping buyer preferences.

- First-time buyers are increasingly entering the market, driven by affordability and government incentives.

- Larger apartments with open-plan layouts are becoming more desirable due to remote work trends.

- Investing in emerging suburbs like Melton and Point Cook can yield higher returns as they develop.

- Understanding suburb growth potential and accessibility is crucial for long-term investment success.

- Monitoring market trends and forecasts helps align your investment strategy with potential risks and opportunities.

- Engaging with buyer’s agents can provide valuable insights and guidance tailored to your needs.

Melbourne Off-the-Plan Investment Landscape: Key Factors & Opportunities

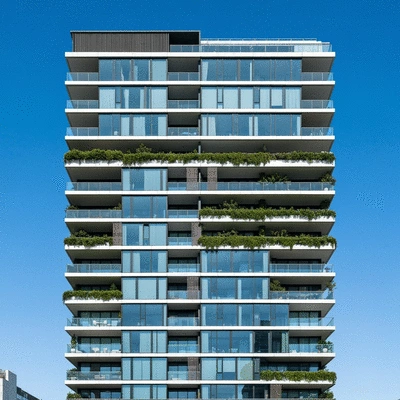

This visual summarizes critical factors for evaluating off-the-plan properties and highlights various investor demographics and their preferences in Melbourne's dynamic real estate market. Understanding these elements is key to informed investment decisions. For more detailed insights into the broader market, check out our analysis of Melbourne property market insights for 2025.

Key Investment Evaluation Factors

- Developer Reputation

- Suburb Growth Potential

- Infrastructure Dev.

- Rental Market Demand

Investor Demographics & Preferences

- First-time Buyers: Affordability, Incentives

- Investors: Capital Growth, Yield

- Families: Spaciousness, Amenities

- Remote Workers: Larger Apartments

Key Market Trends

- Demand for Sustainable Living

- Shift to Larger Apartments

- Emerging Suburb Popularity (e.g. Werribee)

- Community-Oriented Developments

Success Strategies & Next Steps

- Thorough Research & Proactivity

- Utilize Property Research Reports

- Engage Local Buyer's Agents

- Explore Listings & Market Insights

Understanding the Off-the-Plan Investment Landscape in Melbourne

Investing in off-the-plan properties can be a game changer in Melbourne’s real estate market! As we navigate through the vibrant and often complex landscape, it's crucial to understand the current dynamics at play. This section will guide you through the latest trends, demographics, and insights that can empower you to make informed investment decisions.

Current Market Trends for Off-the-Plan Properties

Right now, Melbourne's off-the-plan market is buzzing with activity! Buyers are showing increased interest, particularly in new developments that promise modern amenities and sustainable living options. Let's explore some significant trends influencing this investment landscape.

- Growing demand for sustainable living solutions

- Increased interest in larger apartments due to remote working patterns

- Emerging suburbs like Werribee and Craigieburn gaining popularity

More and more, I see buyers looking for properties that align with their lifestyle preferences. This shift is reshaping the market, making it essential to stay ahead of trends if you're considering investing. Understanding these shifts can truly impact your investment strategy! For those looking for the best investment opportunities, delving into Melbourne's top suburbs for investment is highly recommended.

Insights into Investment Demographics and Preferences

When examining who is purchasing off-the-plan properties, it's clear that a diverse mix of buyers is entering the market. Young professionals, families, and investors are all seeking different features based on their unique needs. I’ve noticed an uptick in demand from first-time buyers eager to capitalize on government incentives and low interest rates!

- First-time buyers looking for affordability

- Investors seeking long-term capital growth

- Families desiring spacious living areas with access to amenities

This diversity in buyers is crucial for understanding the evolving preferences in the market. It’s all about adapting to what potential residents want in their communities—something I emphasize to my clients at My Metro Life.

Shifts Towards Larger Apartments and Emerging Suburbs

As mentioned earlier, there’s a noticeable shift towards larger living spaces. More people are prioritizing comfort and space, especially in the wake of the pandemic. This trend is particularly evident in emerging suburbs like Melton and Point Cook—places you might not have considered but are gaining traction quickly.

- Preference for open-plan layouts

- Demand for outdoor spaces and amenities

- Interest in community-oriented developments

Investing in these up-and-coming areas can often yield better returns as they continue to develop and attract new residents. Are you thinking about where to look next? Keep these areas in mind as you explore your options!

Analyzing Melbourne Real Estate Market Trends and Forecasts

To make informed decisions, we must also consider the broader market forecasts. Current projections suggest a steady increase in prices for off-the-plan properties, influenced by population growth and urban development strategies. It's important to stay updated on these trends.

- Average price increases in key suburbs

- Government initiatives to bolster housing supply

- Potential interest rate fluctuations affecting buyer capacity

In my experience, aligning your investment plans with these market insights can significantly enhance your chances for success. As we move forward, remember, knowledge is power—especially in the world of real estate!

Evaluating Melbourne’s Off-the-Plan Investment Opportunities

Now that we’ve established the current landscape, it’s time to dive deeper into how to evaluate these investment opportunities effectively. Making the right choices hinges on understanding key factors that can influence your return on investment.

Key Factors to Consider When Buying Off-the-Plan

When considering an off-the-plan property, there are several critical factors to keep in mind to ensure you’re making a wise investment. Here’s what I recommend looking into:

- Reputation of the developer

- Location and suburb growth potential

- Future infrastructure developments in the area

- Market demand for rental properties

These elements can significantly impact your long-term success as an investor. I always emphasize doing thorough research before making any commitments!

Assessing Suburb Growth Potential and Accessibility

Suburb growth potential is a pivotal aspect to consider when investing in off-the-plan properties. Areas that offer excellent connectivity and access to public transport tend to attract more buyers and renters alike. I often encourage clients to look for suburbs with planned infrastructure improvements!

- Proximity to major transport hubs

- Access to quality educational institutions

- Amenities such as parks, shopping centers, and healthcare facilities

Choosing a suburb that scores high on these factors can set you up for ongoing success and yield greater returns in the long run.

Understanding Capital Growth and Rental Yield in Different Suburbs

Last but not least, understanding the capital growth and rental yield of suburbs is essential for making informed investments. Not all suburbs are created equal, and their performance can vary significantly over time. I recommend looking at historical data and market trends! For those interested in maximizing their rental returns, exploring Melbourne's best rental yield areas is a must.

- Research recent sales data in target suburbs

- Study rental demand trends and vacancy rates

- Consult property reports for expert insights

By evaluating these aspects thoroughly, you can make decisions that align with your financial goals and investment strategy, giving you the best chance at success in Melbourne’s competitive market.

Pro Tip

When considering off-the-plan investments, always research the developer's track record. A reputable developer not only ensures quality construction but also enhances the potential for capital growth. Look for developers with a history of delivering projects on time and within budget, as this can significantly impact your investment's success.

Frequently Asked Questions (FAQs)

- What are off-the-plan properties?

- Off-the-plan properties are properties purchased before construction is completed, often based on architectural plans and specifications.

- What are the current trends in Melbourne's off-the-plan market?

- Current trends include a growing demand for sustainable living solutions, increased interest in larger apartments due to remote work, and rising popularity of emerging suburbs like Werribee and Craigieburn.

- Who is investing in off-the-plan properties?

- A diverse mix of buyers including first-time buyers seeking affordability, investors aiming for capital growth, families desiring spacious living, and remote workers looking for larger apartments.

- Which suburbs are considered emerging for off-the-plan investments?

- Suburbs like Melton and Point Cook are gaining traction due to ongoing development and increasing attractiveness to new residents.

- What key factors should I consider when buying off-the-plan?

- Key factors include the developer's reputation, suburb growth potential, future infrastructure developments, and market demand for rental properties.

- How important is suburb growth potential for long-term investment success?

- Suburb growth potential is crucial. Areas with excellent connectivity, access to public transport, quality educational institutions, and amenities tend to attract more buyers and renters, leading to greater returns.

- Where can I find reliable market forecasts for off-the-plan properties?

- You can find reliable market forecasts in property research reports, local council announcements, and by engaging with property experts and buyer’s agents.

Summarizing Key Takeaways for Off-the-Plan Investment Success

As we wrap up our exploration of the off-the-plan investment landscape in Melbourne, it’s essential to recap the key steps and strategies that can help you succeed. Investing in off-the-plan properties can be a rewarding venture when approached thoughtfully. Let's revisit some critical insights that can empower your investment decisions.

Recap of Essential Steps and Strategies

- Conduct Thorough Research: Familiarize yourself with the latest market trends and suburb performance data.

- Evaluate Developer Track Records: Always assess the reputation and past projects of the developers before committing.

- Understand Financial Incentives: Keep an eye on available grants, subsidies, and tax benefits that can enhance your investment.

- Be Aware of Risks: Recognize potential pitfalls such as market saturation and ensure you have strategies to mitigate them.

- Engage Professionals: Don’t hesitate to connect with buyer’s agents or property experts for guidance tailored to your needs.

Each step plays a crucial role in positioning you for success. By following these strategies, you’ll be well-equipped to make informed decisions in the Melbourne property market.

Encouraging Proactive Research and Decision-Making

At My Metro Life, I believe that proactive research is the cornerstone of successful property investments. Rather than waiting for opportunities to come to you, actively seek out insights and information. Connect with local communities, attend property expos, and don’t shy away from engaging in discussions with seasoned investors and professionals. Every conversation can lead to valuable knowledge!

Moreover, staying updated with the latest news in the real estate sector can provide you with a competitive edge. Utilize resources like market analysis reports, local council announcements, and upcoming development plans to inform your decisions. Remember, your investment journey is uniquely yours, and the more informed you are, the better positioned you’ll be to seize the right opportunities!

Taking the Next Steps in Your Investment Journey

Connecting with Local Buyer’s Agents and Resources

Now that you have a solid understanding of off-the-plan investments, it’s time to take actionable steps. One of the best moves you can make is to connect with local buyer’s agents who specialize in the Melbourne market. They can provide invaluable insights and help you navigate the complexities of purchasing off-the-plan properties.

Exploring Available Listings and Market Insights

Be sure to explore available listings that align with your investment goals. Use online property portals to filter options based on your criteria, such as location, budget, and desired amenities. Remember, the right property can significantly impact your investment trajectory!

Utilizing Property Research Reports for Informed Decisions

Lastly, don't underestimate the power of property research reports. These documents provide an in-depth look at market trends, suburb performance, and forecasts. At My Metro Life, I emphasize the importance of using such reports to inform your decisions. They can help you identify growth areas and potential risks, making you a more confident and informed investor. For further reading, consider reviewing our Melbourne property market insights for 2025 to refine your strategy.

Recap of Key Points

Here is a quick recap of the important points discussed in the article:

- Stay Informed on Market Trends: Keep up with the demand for sustainable living and larger apartments influenced by remote work.

- Understand Buyer Demographics: Recognize the diverse needs of first-time buyers, families, and investors to tailor your investment strategies.

- Focus on Emerging Suburbs: Consider areas like Werribee and Craigieburn that are gaining popularity for potential growth.

- Evaluate Developer Reputation: Research developers' track records to ensure the quality of off-the-plan properties.

- Utilize Professional Guidance: Engage with local buyer’s agents for expert insights and support throughout the investment process.